Why are Special Licenses so Painful in SAP?

VAT in SAP often feels like a maze of exceptions, workarounds, and endless manual fixes. Our video series exposes the most common pitfalls.

What are Special Licenses?

Many businesses are continually looking at ways to optimize their VAT position and reduce the amount of input credit that they incur. This is particularly the case in countries where the refund process can be quite lengthy. Companies will often look to use special licenses which removes input VAT charged by their suppliers.

In certain EU member states like France, Italy, and Ireland, there is the use of these special licenses. However, there’s a lot of conditions and criteria attached to such licenses and there’s a lot of risk also. As such it’s important that the license is operated correctly.

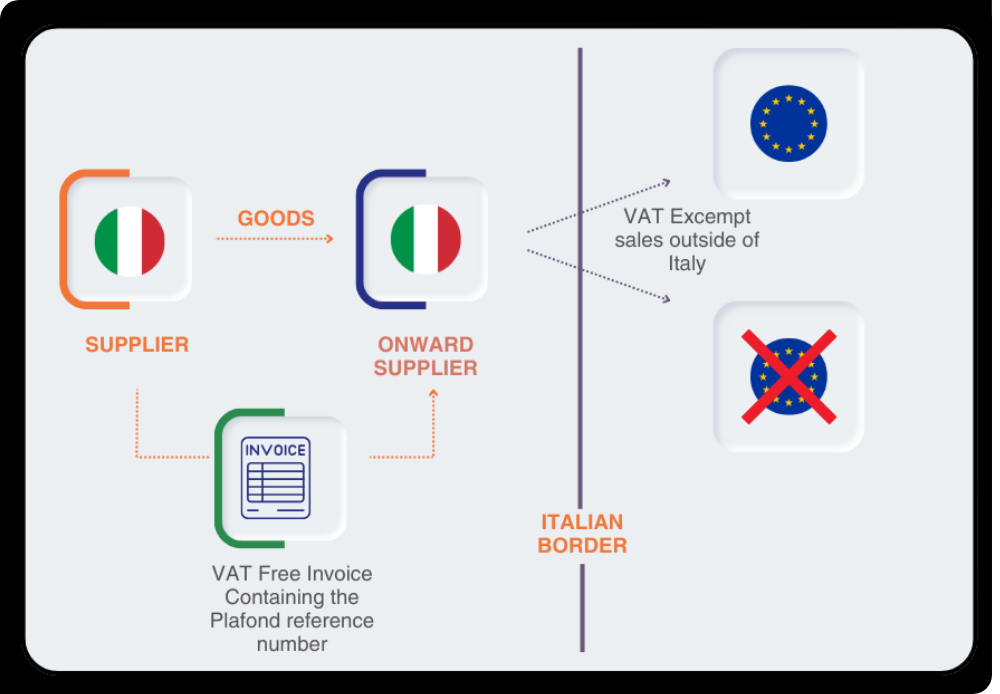

Example Plafond Flow

As an example, we have an Italian supplier selling to an Italian customer, but that customer holds a special license. And up to the value of the license, the holder is allowed to purchase without any VAT being charged.

The onward sales of those purchased goods are in fact without VAT. This could be that the goods are dispatched to another EU member state or that there is an export of goods to a third country or it could even be b two c sales within the framework of distant sales where those goods are taxable in another member state.

Watch the Video: Special Licenses Explained

We explain in detail what Special Licenses are, and how you can use them

How do you use Special Licenses?

In many cases, the license can be quite complicated to manage. So, there are certain conditions that surround this.

- The license is generally valid just for one year after it’s given by the local VAT authority

- The Special License has a specific reference number.

- It is important that the supplier selling to the holder of the license puts this reference number on his invoices

- The license itself will have a specific value.

- When the license holder wants to use some of this threshold, and he can use it for different suppliers, different transaction types, and one off transactions.

- Once the license is used up the threshold, the supplier will go back to just charging the applicable VAT rate on his domestic supplies of goods.

How Meridian Tax Technology for SAP Manages Special Licences

It is really a key challenge from an SAP perspective is not just to get the right VAT treatment on a particular invoice. It's to show that, a supplier has a mechanism in place to monitor the license threshold, and to also demonstrate in the event of an audit how they're they are managing this.

Download the Guide to Special Licenses

Our Guide explains what are Special Licenses and why a business would use them.

- why do businesses use Special Licenses

- how do Special Licenses and thresholds work

- what challenges do Special Licenses present for SAP

- how does Meridian automate the process for Special Licenses

Known VAT Issues in SAP

There are many known VAT issues in SAP including Supply and Install Flows, Domestic Reverse Charges, Cross Border Consignment Flows, Special VAT Regions. Toll Manufacturing, and many more. Our tax technology and VAT compliance experts are on hand to discuss these challenges with you, and advise how to automate many of the processes with Tax Technology.